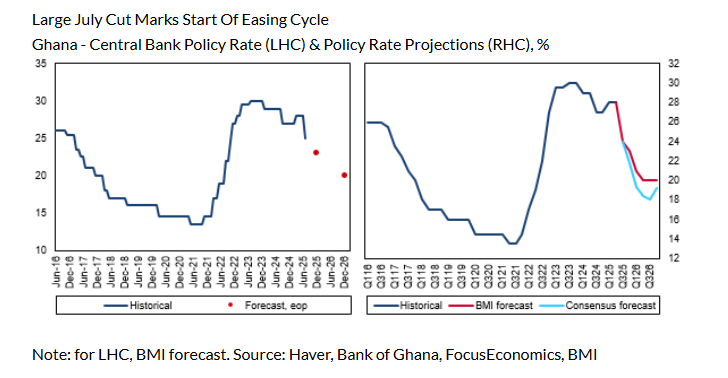

The Bank of Ghana (BoG) will lower its benchmark interest rate to 23.00% by the end of 2025 and 20.00% by the end of 2026, Fitch Solutions has revealed in its latest report on Ghana.

This follows a steep 300-basis points (bps) cut to 25.00% in July 2025.

In a paper on “Monetary Easing To Persist In Ghana Until Mid-2026”, the UK-based firm said its forecast of a further 200 basis points of cuts in 2025 and 300 bps in 2026 remains more conservative than the Focus Economics consensus, which expects 583 basis points of easing over the next year and a half.

“We expect that the BoG will cut the policy rate by 100bps to 24.00% at its next Monetary Policy Committee (MPC) meeting in September [2025]”, it estimated.

Long-Term Interest Rate Trajectory

Fitch Solutions anticipates that the central bank will cut the policy rate by another 100bps in November 2025 and that the easing cycle will continue in the first half of 2026.

“As gold prices remain elevated, amid global trade uncertainty and geopolitical risks, the cedi will remain stable over the coming quarters, which will continue to limit imported price pressures. Indeed, we forecast average inflation to moderate from 22.9% in 2024 to 15.5% in 2025 and 12.2% in 2026, allowing the BoG to maintain a dovish stance at the final MPC meeting of 2025 and the first three meetings of 2026”, it added.

At its last meeting, the MPC of the Bank of Ghana cut its policy rate by 300 basis points to 25%. It cited a significant easing in inflation and a robust local currency.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.