Governor of the Bank of Ghana (BoG), Dr Johnson Asiama, has announced that the central bank is pursuing an aggressive plan to reduce the country’s Non-Performing Loan (NPL) ratio to 10 per cent by the end of 2026, down from the current level of 19.5 per cent recorded in October 2025.

The Governor said the target is part of a wider strategy to strengthen asset quality across the banking sector, particularly as macroeconomic conditions improve and interest rates begin to decline.

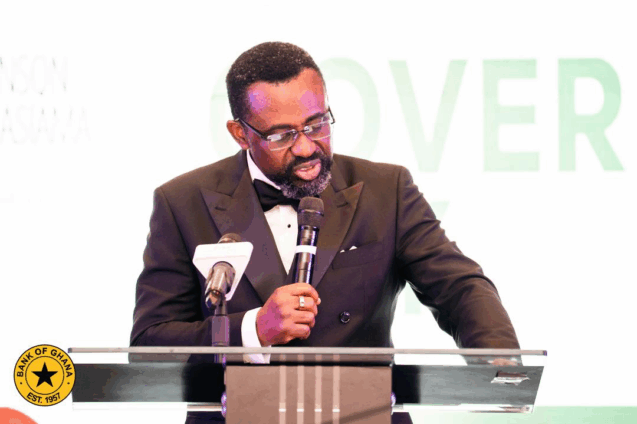

Dr Asiama made the disclosure while delivering a keynote address at the Governor’s Day Annual Bankers’ Dinner, organised by the Chartered Institute of Bankers.

He explained that the easing economic environment should allow banks to restructure loans more intelligently, while still maintaining strict prudential standards.

“As we turn toward 2026, the central question is no longer whether stability can be restored,” he said. “The question is how that stability is used.”

He added that while 2025 marked the rebuilding of confidence, the focus for 2026 must be on deploying that confidence productively and responsibly to support a more competitive Ghanaian economy.

Call for Stronger Export Financing

Beyond banking sector stability, Dr Asiama urged commercial banks to take a more proactive role in supporting Ghana’s export-led growth agenda.

He called on banks to expand export finance desks, deepen support for agro-processing and non-traditional exports, and actively engage opportunities under the African Continental Free Trade Area (AfCFTA).

According to him, banks must move beyond domestic lending and help businesses transition into regional and global markets by financing export-oriented enterprises and managing trade-related risks.

“The banking sector must not sit on the sidelines of Ghana’s export agenda but help shape it,” he stressed.

He encouraged banks to design export-ready loan products, build industry-specific expertise, support hedging and risk-sharing instruments, invest in digital trade platforms, and assist exporters from production through to payment.

“When banks nurture exporters, they are not doing charity,” he noted. “They are expanding the country’s foreign exchange base, strengthening their own balance sheets, and reinforcing the resilience of the financial system.”

2025: A Year of Hard Choices

Reflecting on the past year, Dr Asiama described 2025 as a period defined by difficult but necessary decisions, taken at a time when confidence in policy signals and coordination had significantly weakened.

“When I assumed office, the challenge was not a shortage of ideas or tools,” he said. “It was the erosion of confidence.”

He explained that market behaviour at the time was driven more by uncertainty than conviction, making it difficult for even sound policies to gain traction.

Impact of Reforms

Dr Asiama highlighted a series of reforms implemented in 2025, which he said were instrumental in restoring discipline to both monetary policy and the financial markets.

He revealed that inflation, which exceeded 23 per cent at the beginning of the year, declined steadily into single-digit territory by November, reaching levels last seen in 2019.

Over the same period, the cedi appreciated by more than 20 per cent, a development he attributed to restored market order rather than speculative activity.

He added that sustained disinflation enabled the Monetary Policy Committee (MPC) to reduce the policy rate by a cumulative 1,000 basis points during the year—an outcome he said would not have been possible without firm policy discipline.

Strengthening the Banking Sector

The Governor noted that the reforms extended beyond monetary policy to the commercial banking sector, which entered 2025 still recovering from the effects of the Domestic Debt Exchange Programme (DDEP) and capital adequacy challenges.

At the end of 2024, 11 banks were operating below the required capital thresholds. By November 2025, that number had fallen to five, reflecting recapitalisation efforts, tighter supervision and improving economic conditions.

Dr Asiama also disclosed that the Bank of Ghana is laying the groundwork for the next phase of financial sector growth, aimed at long-term resilience and expansion.

He announced the completion of the National Payment Systems Strategy (2025–2029), which provides a coordinated roadmap for interoperability, cybersecurity, instant payments and modernisation of Ghana’s payments infrastructure.

According to him, the strategy positions Ghana’s financial system to better support economic growth in the years ahead.