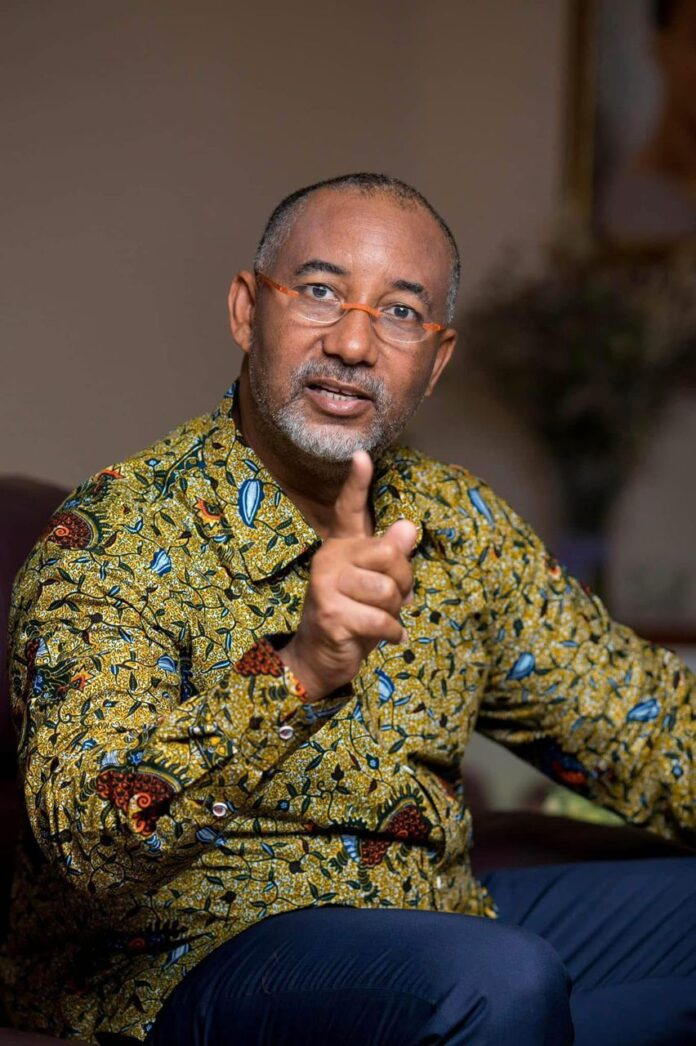

Former Executive Director of Standard Chartered Bank, Alex Mould, is raising critical questions about Ghana’s persistently high interest rates, despite visible improvements in key economic indicators such as inflation and liquidity.

In a detailed critique of the current monetary policy stance, Mr. Mould queried why the Bank of Ghana (BoG) has kept the Monetary Policy Rate (MPR) at a steep 25%, when market trends suggest ample liquidity and declining short-term borrowing costs.

Disconnect Between Policy and Market Reality

The MPR, set by the BoG, serves as a signal to investors, businesses, and consumers about the central bank’s economic outlook. In theory, it should help manage inflation, influence lending behavior, and stabilize growth.

However, Mr. Mould argues that the current policy is misaligned with actual market conditions.

Recent market data supports this view. The 91-day Treasury bill rate has dropped to 10.29%, and short-term government borrowing is similarly priced. The interbank rate—used by banks to lend to each other overnight—is reportedly under 15%, significantly below the MPR.

Additionally, a recent treasury bill auction saw an 85% oversubscription, indicating that banks are awash with liquidity.

“Banks are sitting on excess cash, and some are even turning away fixed-term deposits because it’s costly money,” Mould noted. “Yet we’re not seeing a corresponding drop in lending rates to businesses or consumers.”

The Role of the Ghana Reference Rate

According to Mr. Mould, the high interest rates can largely be attributed to the way the Ghana Reference Rate (GRR) is calculated.

The GRR—a benchmark for setting lending rates—derives 40% of its weight from the MPR, 40% from the 91-day Treasury bill rate, and 20% from the interbank rate.

Despite falling Treasury and interbank rates, the heavy weighting of the 25% MPR keeps the GRR elevated at approximately 23%. This, in turn, continues to suppress affordable lending.

A Call for Policy Action

With inflation trending downward—recorded at 13.7% in June—Mr. Mould is urging the BoG’s Monetary Policy Committee (MPC) to reduce the MPR to below 20% at its next meeting.

“Lowering interest rates reduces the cost of production, brings down prices, and helps control inflation,” he explained. “A stable cedi and falling inflation would allow for positive real interest rates without stifling economic growth.”

He also acknowledged the broader efforts being made to reset Ghana’s economy. “The RESET President John Dramani Mahama promised is clearly underway,” Mould stated, commending Finance Minister Dr. Ato Forson and BoG Governor Dr. Johnson Asiama for their leadership.

“Ghana doesn’t lack liquidity,” Mould emphasized. “What we lack is policy alignment. It’s time to harmonize the MPR with market realities. Our businesses—and the future of our economy—depend on it.”

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.