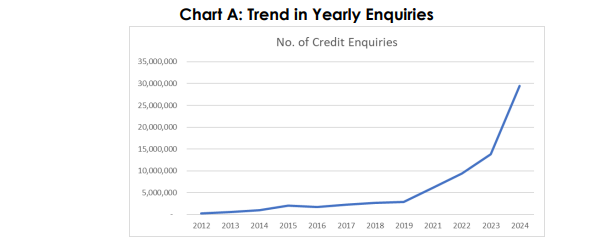

Searches on the database of credit bureaus increased by 114.60% in 2024, the Credit Reporting Activity 2024 has revealed.

This rose from 13,745,137 in 2023 to a total of 29,496,440 in 2024.

According to the report, these searches were conducted by financial institutions and other authorised users of the Credit Reference System.

This significant increase is mainly the result of the growth in digital loans provided by various lenders.

An average of 2,458,037 enquiries were conducted by financial institutions and authorised users each month. This resulted in an increase of 16.24% compared to 2,114,636 average monthly enquiries in 2023.

These increases, the report said, demonstrate the level of acceptance of credit reports/history in the credit management processes among all types of institutions.

Credit Enquiries per Borrower Type

During the year under review, the report said 55% of searches conducted by financial institutions and authorised users on the database of credit bureaus were conducted on individual borrowers. About 44% were also conducted to assess the creditworthiness of digital loan customers.

Meanwhile, searches conducted on corporate customers of lenders reduced from 472,579 in 2023 to 105,953 in 2024.

This decrease, it said, can be attributed to a decline in the number of credits to the private sector due to high interest rates recorded in 2024, and strategic lender credit decisions, primarily due to the persistent cedi depreciation and high NPL rates.

The decrease in the number of enquiries on corporate customers contradicts the 26.3% increase in nominal private sector credit compared to 10.7% in December 2023. This suggested that lenders may be lending substantial loan amounts to a few corporate clients.

On the contrary, the number of enquiries to individuals continued to increase over the years, accentuating the continuous influence of credit reports in the facilitation of retail credit.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.