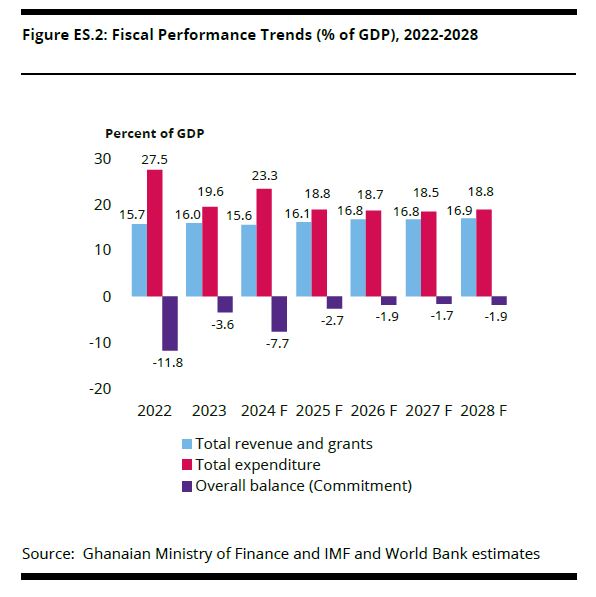

Ghana’s path to fiscal sustainability is on solid ground due to its successful debt management and restructuring efforts, according to the World Bank Group’s 9th Economic Update on Ghana for June 2025.

The report highlights the nation’s progress in nearly completing a comprehensive debt overhaul, which has significantly improved its economic outlook.

The World Bank’s analysis shows that the country’s public debt-to-GDP ratio declined to 70.5 percent in 2024, a notable decrease from an estimated 72.3 percent in 2023.

This positive shift is attributed to the successful debt restructuring, robust economic growth, a less depreciated exchange rate than anticipated, and lower real interest rates.

Ghana has executed a phased and comprehensive debt restructuring strategy, covering over 95 percent of its total public debt. The key milestones of this process include:

- Domestic Debt: The Domestic Debt Exchange Programme (DDEP), which aimed to alleviate the domestic debt burden, was largely completed in 2023.

- Eurobonds: A restructuring agreement with Eurobond holders was concluded in 2024, providing significant relief on a substantial portion of the nation’s external debt.

- Official Creditors: A crucial breakthrough was achieved in January 2025 when a Memorandum of Understanding (MoU) was signed with the Official Creditor Committee (OCC). This committee, co-chaired by China and France, formalized a debt treatment under the G-20 Common Framework. The terms of this agreement were subsequently approved by Ghana’s Parliament in June 2025 for final signature, paving the way for bilateral agreements.

The report notes that a final agreement is still pending with commercial creditors for the remaining external debt of US$2.4 billion, which constitutes less than 5% of the pre-restructuring total public debt.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.