The Money Market Fund of New Generation Investment Services (NGIS) has demonstrated resilience in the wake of volatile market conditions, posting a strong financial performance in 2024 despite a marginal dip in gross investment income.

According to the Fund’s annual report, gross investment income fell slightly by 0.87%, declining from GH₵1,193,494 in 2023 to GH₵1,183,021 in 2024.

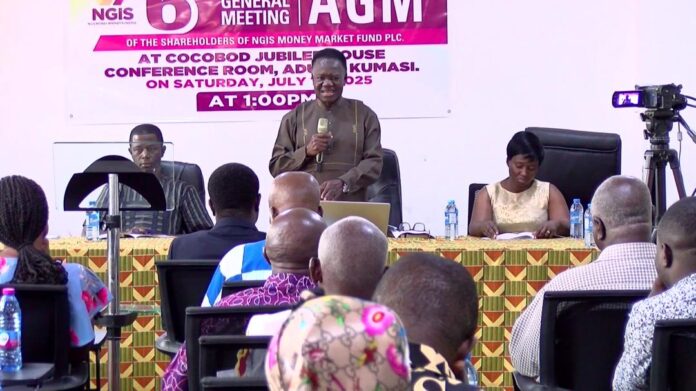

During the 6th Annual General Meeting (AGM) of shareholders in Kumasi, Fund Manager of NGIS, Edward Asamoah, attributed the reduction largely to a modest drop in interest rates on money market instruments.

However, the Fund’s operational efficiency remained firm, as administrative expenditure was trimmed by 1.59%, plummeting from about GH₵73,600 in 2023 to a little above GH₵72,400 in 2024.

Notably, the net investment income grew by 7.36% — rising from more than GH₵1.1million to approximately GH₵1.2million — demonstrating the Fund’s zest to enhance returns even in a tightening rate environment.

Liabilities saw a 35.67% increase, climbing to a little over GH₵84,000. However, on investor side, redemptions dropped by 6.45%, from more than GH₵2.5million to over GH₵2.4million, while sales of shares skyrocketed by a significant 48.45%, reaching above GH₵3.4million in 2024 from GH₵2.3million in the previous year. This reflects the growing investor confidence in the Fund’s long-term prospects.

The Net Asset Value (NAV) per share appreciated from GH₵2.0080 in 2023 to GH₵2.0435 in 2024, with the Fund delivering a competitive yield of 17.56%.

At the end of 2024, the Fund’s portfolio composition included cash and cash equivalents of approximately GH₵340,000, Short-term Investments of almost GH₵7.6million, Medium-Term Investments of close to GH₵705,000, and other assets amounting to a little over GH₵1million. The diversified allocation underscores a strategic balance between liquidity, return, and risk.

Outlook for 2025

The World Bank forecasts the country’s GDP growth to accelerate to between 5.5% and 6% in 2025, driven by a strong performance in the non-oil sector, particularly services and agriculture.

The Fund Manager indicated that the Fund is well-positioned to leverage the expected macroeconomic improvements.

Inflation is projected to ease toward the government’s target range of 10% to 15%, given the continued monetary policies by the Bank of Ghana.

Domestically, effective debt management remains key to sustaining investor confidence and economic recovery.

With these fiscal measures in place, Mr. Asamoah pointed out that the NGIS Money Market Fund is expected to maintain its prudent investment strategy while seeking new opportunities to maximize shareholder value, reinforcing its position as a reliable income-generating fund for Ghanaian investors.

Chairperson of the Board of Directors of the NGIS Money Market Fund, Professor Kwaku Dwomoh Kessey, reaffirmed the Fund’s commitment to protecting investor capital and delivering stable, risk-adjusted returns, even as Ghana’s financial landscape continues to evolve.

Prof. Kessey revealed that the Fund recalibrated its portfolio strategy in 2024 to respond more effectively to shifting market conditions, emphasizing on managing interest rate risk within its fixed-income securities.

“We adjusted our approach to align with the yield dynamics of Post-Domestic Debt Exchange (DDEP) Bonds, which peaked at 10%. Although returns for 2024 were modest—largely due to the timing of reallocation and our cautious stance on risk—we have laid a strong foundation for capital appreciation in 2025 and beyond,” he said.

The Fund’s Investment and Risk Committee is actively exploring additional risk-free instruments to enhance portfolio returns in the coming quarters.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.