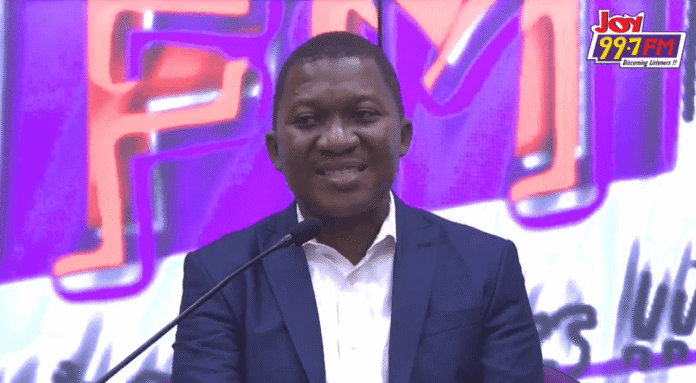

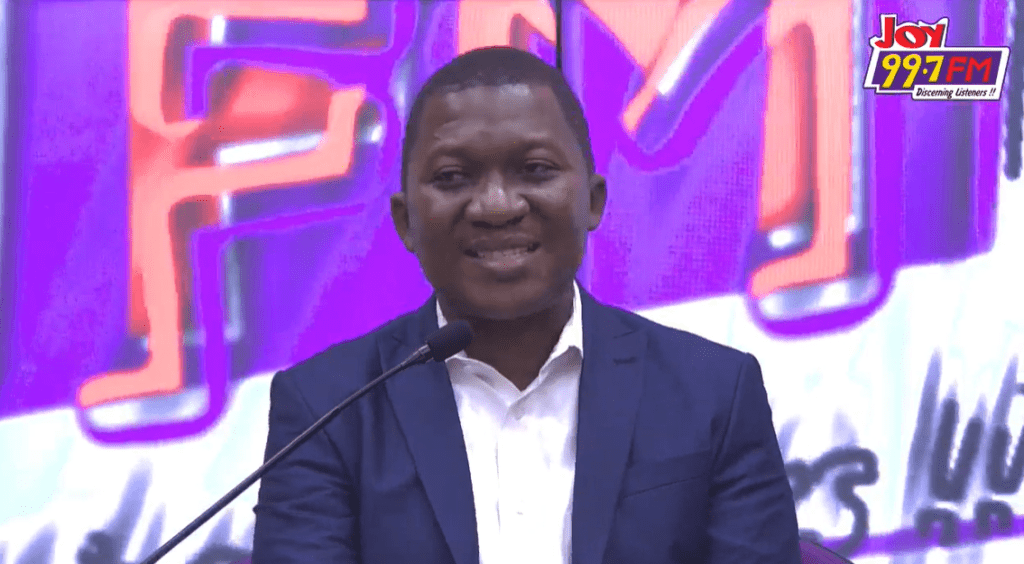

Managing Director of EDC Investment Ltd, Paul Kofi Mantey, has called on Ghanaians to take personal responsibility for their retirement planning, stressing that reliance on Social Security and National Insurance Trust (SSNIT) alone is not enough.

Speaking on Joy FM’s Super Morning Show, Wednesday, July 23, he explained the urgency of retirement preparedness. “The last time I checked, the number of Ghanaians who are more than 60 who are on SSNIT pension are less than 300,000. So you have 1.7 million Ghanaians who are not on SSNIT pension. And that makes it very important to talk about retirement planning.”

He expressed concern that even among those receiving pensions from SSNIT, most are getting modest monthly sums. “Even the less than 300,000 who are on SSNIT pension, the last time I checked, over 90% of them were on a pension between GH₵300 and GH₵5,000 a month,” he said.

Mr Mantey stressed that income levels in Ghana are generally low, which affects the size of pensions. “Remember the pension is a function of your income. Income levels are relatively low so I would say that SSNIT is mandatory by law, so we all need to pay SSNIT, but beyond paying your SSNIT, you have a responsibility to pay attention to your retirement and plan for it,” he added.

Referring to the recent pension adjustments, Mr Mantey cited figures from SSNIT’s 2025 indexation policy.

“This morning I went to the SSNIT website and I was checking the indexation for 2025 and it stated that 63% of SSNIT pensioners receiving GH₵1,814 or less will enjoy an increment up to 32%, depending on the level. So after the 2025 indexation and the increment, now it moves to GH₵2,033. And the lowest is GH₵397,” he explained.

He also shed light on a common issue affecting pension calculations: the disparity between basic salaries and allowances.

“There are a number of workers who are on high allowances and very low basic. The income on which the pension contribution is calculated is lower, and the allowances are huge. They are enjoying today, but the pension they’re going to have when they retire is going to be low,” he said.

Mr Mantey advised that consolidating allowances into basic salary could improve future pension payouts. “Instead of consolidating everything so that the contribution to your pension into your future is higher, a number of people will prefer the high allowances,” he said.

“This is the reality, this is the situation. It’s the reason why we are having this conversation. I will encourage our listeners and viewers to take a sample of people who are retired and ask themselves if this is the kind of retirement they want to have. When you look at them, a number of them, it’s nothing to write home about,” he added.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.